What happens when someone dies and leaves behind several debts? Who is responsible for paying off the debts? Who gets paid first?

Whenever someone dies and leaves debts behind, a designated person (called an executor or administrator) handles the estate. If the deceased person did not have a will and was married, then, in many states the spouse automatically assumes responsibility for the estate and, becomes responsible for paying off the debts on his or her own. If the deceased person did not have a will and did not have a living spouse, then usually a close relative (son, daughter, mother, father, or a grandparent) is appointed as the executor of the estate according to state law. If there are no relatives, the state appoints an executor.

Even when an estate is worthless, the executor must still notify all creditors of the death. Debts from a worthless estate are generally charged off and no future collection actions are taken. However, as stated earlier, in some states a living spouse can still be held responsible for paying off the debts of their deceased spouse.

Always check your state laws and always consult with a probate attorney.

When the estate is worth something, the debts must be satisfied according to federal and state priority. For instance, debts owed to the federal government take first priority and then state governments debts and after that, it depends on the types of debts and whether or not there is a will. Assuming there is a will, its instructions are followed and then comes secured debts, liens, judgments and finally unsecured debts. Here are two relevant excerpts from federal code…

“Section 3466 provides: ‘Whenever any person indebted to the United States is insolvent, or whenever the estate of any deceased debtor, in the hands of the executors or administrators, is insufficient to pay all the debts due from the deceased, the debts due to the United States shall be first satisfied; and the priority hereby established shall extend as well to cases in which a debtor, not having sufficient property to pay all his debts, makes a voluntary assignment thereof, or in which the estate and effects of an absconding, concealed, or absent debtor are attached by process of law, as to cases in which an act of bankruptcy is committed.’ ”

“Section 3467 (Comp. St. 6373) provides: ‘Every executor, administrator, or assignee, or other person, who pays any debt due by the person or estate from whom or for which he acts, before he satisfies and pays the debts due to the United States from such person or estate, shall become answerable in his own person and estate for the debts so due to [269 U.S. 483, 487] the United States, or for so much thereof as may remain due and unpaid.’ “

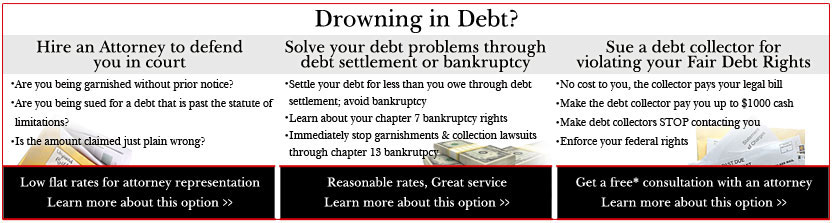

Closing out an estate when debts remain can become very complicated very quickly! There are specific federal and state rules and procedures that must be followed. It’s always best to consult an attorney well versed in estate law. Should you need an attorney, use this link to find a prescreened local attorney. The service offers a $1,000 money back satisfaction guarantee!