Johnson Mark LLC

Are you receiving collection calls and letters from the debt collection law firm Johnson Mark LLC? Then your rights may have been violated under the Fair Debt Collection Practices Act (“FDCPA”). A Debt Help Lawyer may be able to help you stop Johnson Mark LLC’s debt collection efforts, and you may even be entitled to a cash payment if your rights have been violated!

If your rights have not been violated, you still have option! Other options include paying a reduced portion of the debt through “debt settlement” or bankruptcy. Don’t just put up with debt collector abuse . Review the information below to find out more about this well known debt collector or fill out our free attorney case review form and get help stopping the calls and letters from Johnson Mark!

Johnson Mark LLC

4246 S. Riverboat Road, Suite 100

Salt Lake City, Utah 84123

Phone: (888) 599-6333

Fax: (877) 288-5701

Web Address: www.jmlaw.com

How does Johnson Mark LLC violated consumer’s rights?

Recently, it has been discovered that Johnson Mark is sending letters to consumers where the debt buyer’s name (or the creditor’s name) appears through the windowed envelope. Under the Fair Debt Collection Practices Act, debt collectors such as Johnson Mark are prohibited from using any language or symbol, other than the debt collector’s address, on an envelope when communicating with a consumer via the mail. However, a debt collector may use its business name if such name does not indicate that it is in the debt collection business. By disclosing the name of the creditor through the window of the envelope, Johnson Mark LLC may violate this prohibition. Often, the debt buyer’s name gives an indication that it is a debt collector. By making this information visible to anyone handling the envelope, Johnson Mark risks disclosing the consumer’s private information to third parties.

Given Johnson Mark LLC regularly files lawsuits against consumers, your rights may also be violated if you are sued in the wrong jurisdiction. Under the FDCPA, debt collectors may only file lawsuits against consumers in the judicial district where the consumer signed the contract giving rise to the debt or where the consumer resides at the time. So if you’ve been sued for a debt, you should first confirm that you were sued in the proper jurisdiction. If you were not, your FDCPA rights may have been violated and you may be entitled to receive money damages. A Debt Help Lawyer may be able to help you TODAY!

What creditors or debt buyer’s does Johnson Mark LLC represent?

As a law firm, Johnson Mark LLC may represent a wide variety of creditors and debt buyers, which may change over time, both before legal action is taken to attempt to collect a debt and after. Johnson mark may represent first party creditors such as Credit One Bank, N.A., Capital One Bank (USA), N.A., Barclays Bank, Bank of America, N.A. (itself, and as successor in interest to FIA Card Services, N.A., and others.

Additionally, Johnson Mark LLC has represented a variety of third party debt buyer’s. These entities may also be considered “debt collectors” under the FDCPA if the principal purpose of their business is the collection of debts. Johnson Mark may represent third party debt buyers such as LVNV Funding, LLC, CACH, LLC, Resurgent Capital Services L.P., Midland Funding LLC, Portfolio Recovery Associates, LLC, and Gemini Capital Group.

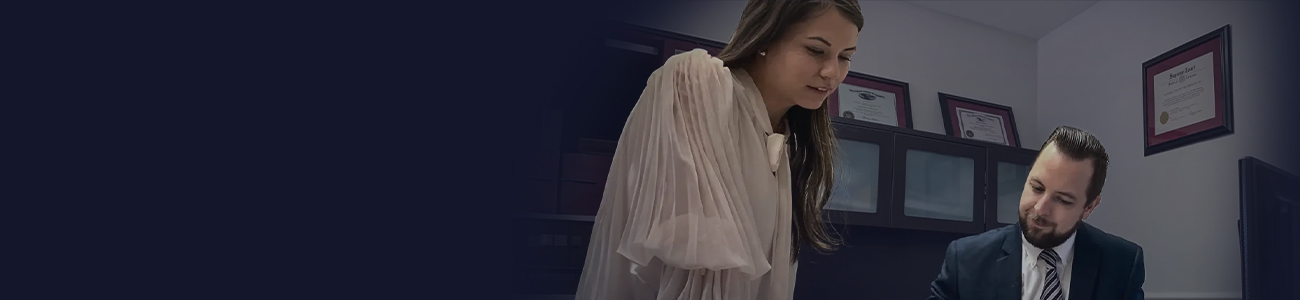

About Debt Help Lawyers

Debt help lawyers want to help consumers fight back against debt collection agencies that use unfair debt collection practices including harassment in attempt to collect debts. Debt collection companies who use harassment including harassing phone calls and harassing debt collection letters are breaking consumer protection laws for debt collection. You have rights and can fight back against these debt collection corporations, contact the Debt Help Lawyers on this site today for help with abusive debt collectors, for help settling your debts for less than you owe (debt settlement), for assistance with wage garnishment or debt collection lawsuits, for advice on filing bankruptcy or to adjust your home loan!