15 U.S. Code § 1692d – Harassment or abuse

The FDCPA, or Fair Debt Collection Practices Act, is one of the primary collector harassment laws we use to end debt collection harassment and abuse. This is a broad, expansive law, and section “d” covers a whole lot of bill collector harassment, including but not limited to harassing collection calls.

One common collection agency harassment tactic collectors love is calling you repeatedly, just to harass and annoy you into paying the debt. These bills collector harassment calls could be repetitive within a short period of time (for example, several calls in a single day). Harassing debt collectors can also engage in a longer term, more persistent harassment campaign (a call a day, over a longer period of time such as a few months). Many other harassing calling patterns in between can violate debt harassment laws as well. And collection call harassment isn’t limited to the times you actually speak to a collector and includes harassing voice messages and even hang-ups.

And when harassing bill collectors do reach you, there are things the collector cannot say, as well as things they must say. For example, debt collection harassment includes obscene, profane or abusive language, and they can’t make threats of violence or other criminal means. And, they also can’t make debt harassment mystery calls—they collector has to meaningfully disclose his/her name and the name of the debt collection company (e.g., “this is Joe Collector with Smith Collections Inc.”). And harassing phone calls at work can further violate your rights.

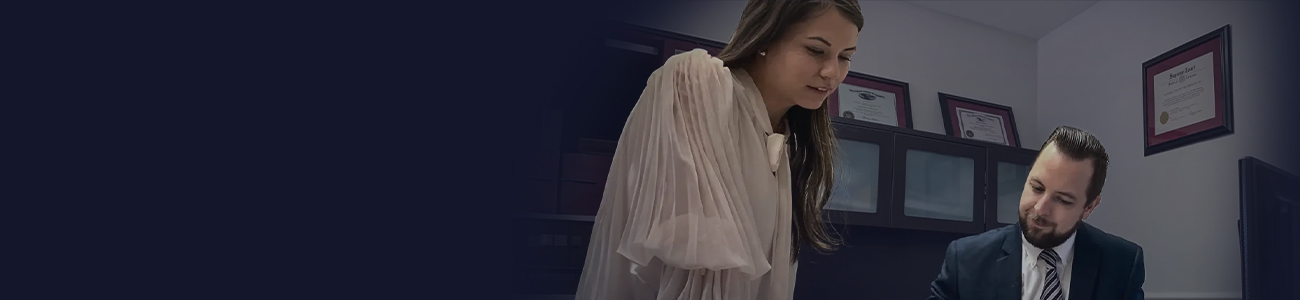

So don’t wonder how to stop collection agency harassment or whether any collection harassment laws were violated, have all your collection accounts reviewed by an experienced Fair Debt attorney.

Although a lot of the FDCPA’s violations are obvious, it is actually the FDCPAs technical requirements—the things most non-lawyer consumers don’t know—that are most frequently violated, because collectors figure these technical violations are the easiest to slip by the average person. Little things like debt collection letters, bill collection voice mails, debt collector call logs, and detailed notes of conversations with debt collectors, as well as credit report entries showing collector pulls and reporting, can all form powerful evidence in the fight against debt collection. And the FDCPA not only protects you from harassment from debt collectors, but it also requires the debt collector would be penalized and have to pay the consumer a monetary award, even where you suffer no harm. The debt collector also has to pay your attorney fees, meaning you can usually enforce your FDCPA rights at no cost to you.

And even if the FDCPA doesn’t apply or wasn’t violated for one reason for another, the collector or someone else in the account chain may have violated other rights of yours, for example, the account could be improperly credit reported in violation of the FAIR CREDIT REPORTING ACT or they could be using a dialer to ring your phone in violation of the TELEPHONE CONSUMER PROTECTION ACT.

15 USC 1692d

A debt collector may not engage in any conduct the natural consequence of which is to harass, oppress, or abuse any person in connection with the collection of a debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

1692d(1)

The use or threat of use of violence or other criminal means to harm the physical person, reputation, or property of any person.

Analysis

A debt collector can violate this section by an express or even implied threat of violence. For example, a debt collector may not pressure a consumer with statements such as “we’re not playing around here–we can play tough” or “we’re going to send somebody to collect for us one way or the other.”

1692d(2)

The use of obscene or profane language or language the natural consequence of which is to abuse the hearer or reader.

Analysis

Abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

1692d(3)

The publication of a list of consumers who allegedly refuse to pay debts, except to a consumer reporting agency or to persons meeting the requirements of section 1681a(f) or 1681b(3) [1] of this title.

Analysis

Prohibits the “publication of a list of consumers who allegedly refuse to pay debts,” except to report the items to a “consumer reporting agency,” as defined in the Fair Credit Reporting Act or to a party otherwise authorized to receive it under that Act.

1692d(4)

The advertisement for sale of any debt to coerce payment of the debt.

Analysis

This is essentially an “anti-shaming” provision, designed to prohibit debt collectors from coercing a consumer into payment, by publicizing the debt. This provision can also prohibit a debt collector from distributing a list of alleged debtors to its creditor subscribers. However, a coded lists, for example, one showing only the driver’s license number and first three letters of each consumer’s name would not violate this provision, because such publication is permitted under the Fair Credit Reporting Act. Providing a list for use by an investigator also does not violate this provision, so long as the contact is “reasonably necessary to effectuate a post-judgment judicial remedy.” Finally, a public notice required by law (for example, as a prerequisite to enforcement of a security interest in connection with a debt) doesn’t violate this section.

1692d(5)

Causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Analysis

The key here is “intent,” why does the collector keep calling? If there are multiple calls in a day, or continuous, one right after the other, intent to harass and annoy may be inferred.

1692d(6)

Except as provided in section 1692b of this title, the placement of telephone calls without meaningful disclosure of the caller’s identity.

Analysis

This provision requires the collector make clear to the consumer who he is. Depending on the laws of its state, the collector may use a registered alias (i.e., where he uses the alias consistently, and his true identity can be ascertained by the employer) and an individual debt collector must disclose his name and employer’s identity when discussing the debt on the telephone with consumers.

(Pub. L. 90–321, title VIII, § 806, as added Pub. L. 95–109, Sept. 20, 1977, 91 Stat. 877.)